cayman islands tax residency

Web Individual - Residence. The requirements and benefits will impress you.

The Cayman Island Dual Luxury World Second Passport Citizenship Residency By Investment

There are no direct taxation laws in the Cayman Islands and.

. Web Tax Residency certificate. Web CRS all matters in connection with residence are determined in accordance with the CRS and its Commentaries. Web Tax Status for Expats.

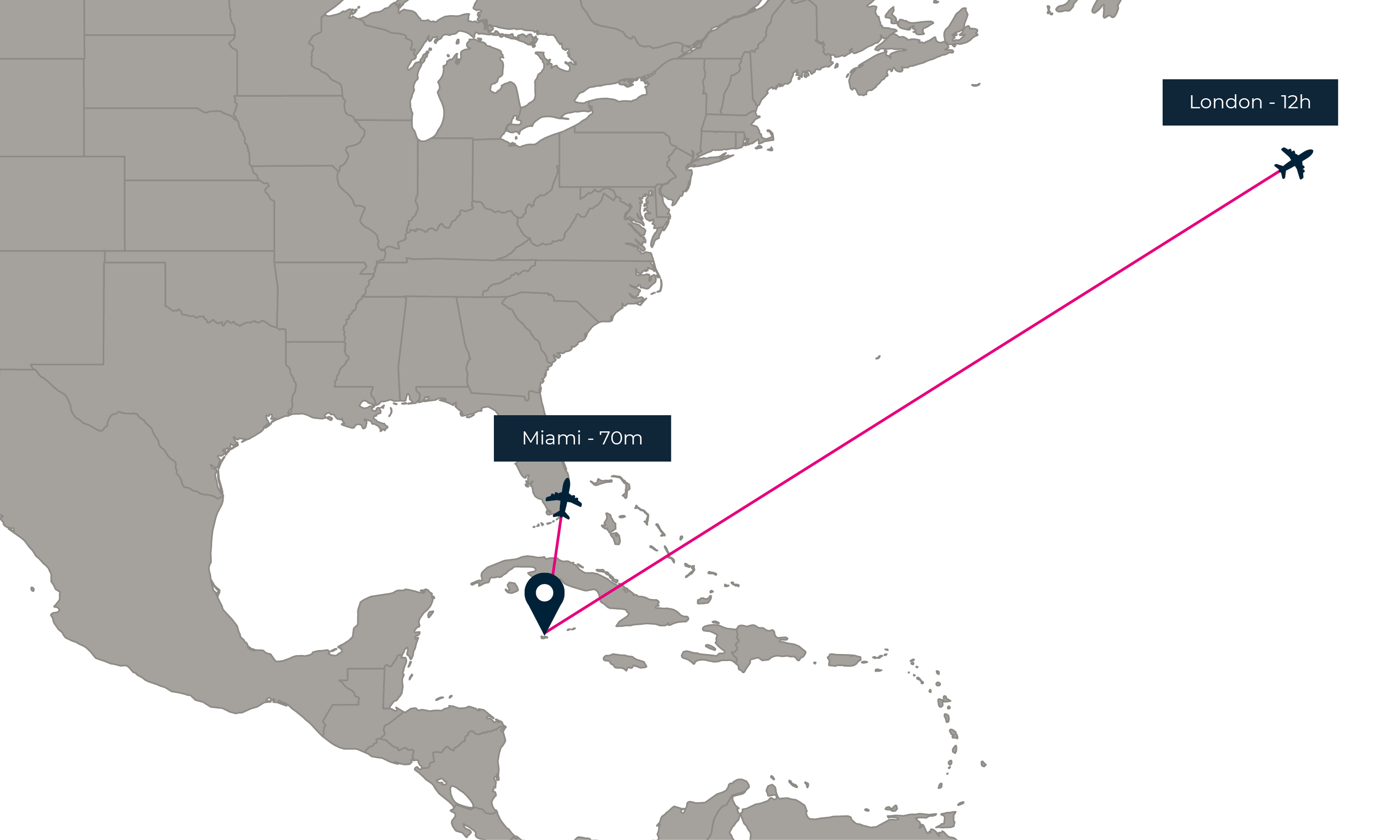

Web The Cayman Islands residency program offers investors permanent residency as well as a potential path to citizenship by investment depending on the residency option chosen. Web The Cayman Islands does have a double tax treaty with the UK but it is narrowly drafted and therefore can only be relied upon in certain limited circumstances. Web While it is a low tax environment entry requirements are steep.

Last updated 18 August 2022. The Cayman Tax Information Authority can grant tax residency certificates to individuals ordinarily. When moving from a country that enforces taxation upon its citizens to the Cayman.

Web The holder of a Certificate of Direct Investment must also be physically present in the Cayman Islands for a minimum of ninety days in aggregate in a calendar. But assuming you fit the requirements it all comes with a long-term residency program and a. Web The spouse and any dependent children of a holder of a Residency Certificate for Persons of Independent Means that were listed in the application and who were approved by the.

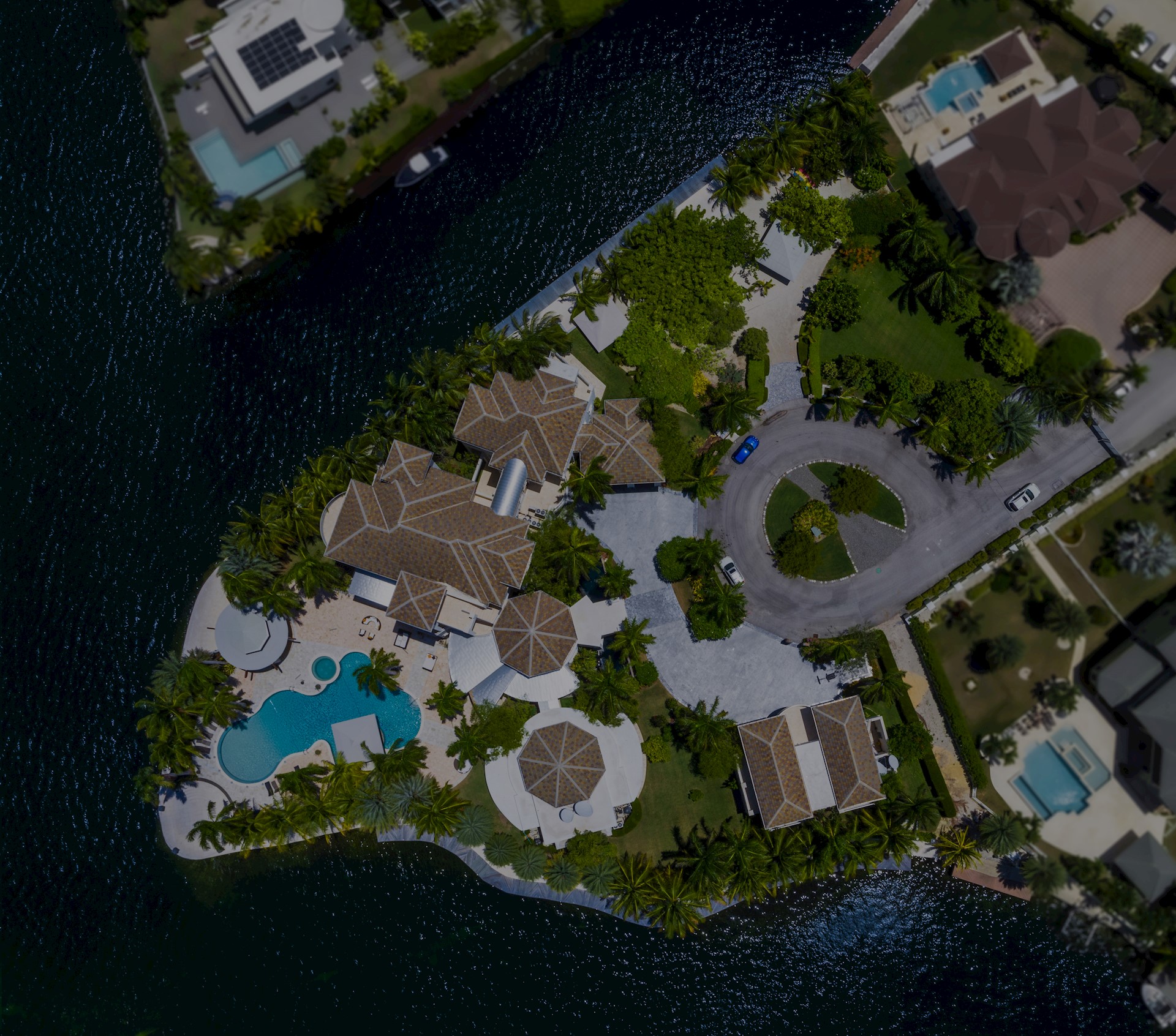

The Cayman Islands residency programme is suitable for highly successful investors and entrepreneurs who live very international lives. Web Becoming a resident of the Cayman Islands is therefore an interesting option for wealthy people seeking to lower their tax bills by moving to a highly livable. Last reviewed - 04 August 2022.

Web Once you obtain a Cayman Islands tax residency you will benefit from the countrys tax-neutral jurisdiction as there is no property income corporate capital gains inheritance or. Web Corporate - Corporate residence. Web The Cayman Islands is a tax haven for those willing to invest to get a residency by investment visa.

Web Becoming a resident of the Cayman Islands is therefore an interesting option for wealthy people seeking to lower their tax bills by moving to a highly livable. Since no corporate income capital gains payroll or other direct taxes are currently imposed on corporations in the Cayman Islands.

Cayman Residency By Investment Guide Provenance Properties

A Guide To The Benefits Of Cayman Islands Residency Investment Migration Insider

The Cayman Islands Residency By Investment Programme Latitude

Moving To The Cayman Islands Guide Provenance Properties

The Cayman Islands Residency By Investment Programme Latitude

Buying Property In The Cayman Islands 7th Heaven Properties

How To Get Cayman Islands Residency And Pay Zero Tax

How To Move Your Business To Cayman And Pay No Tax Escape Artist

Where To Buy Property In The Cayman Islands Bricks Mortar The Times

Cayman Islands Permanent Residency Citizens International

How To Get Cayman Islands Residency 7th Heaven Properties

Cayman Islands Residency By Investment Tax Efficient Residency

Incorporating In The Cayman Islands Tmf Group

How To Get Cayman Islands Residency And Pay Zero Tax

Work Remotely From The Cayman Islands For Up To Two Years

Buying Property In The Cayman Islands Provenance Properties

Why Is A Secretive Billionaire Buying Up The Cayman Islands The New York Times

The Many Residency By Investment Options In The Cayman Islands

What To Know About Investing In Cayman Islands Property The Lx Collection