charitable gift annuity minimum age

A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to charity and the charity gives back an agreed-upon income stream to the donor for the. Many require donors to contribute a minimum of 10000 to 25000 and to be at least age 65 to begin receiving payments says Laurie Valentine of the American Council on.

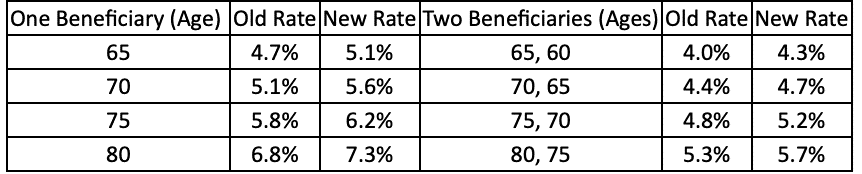

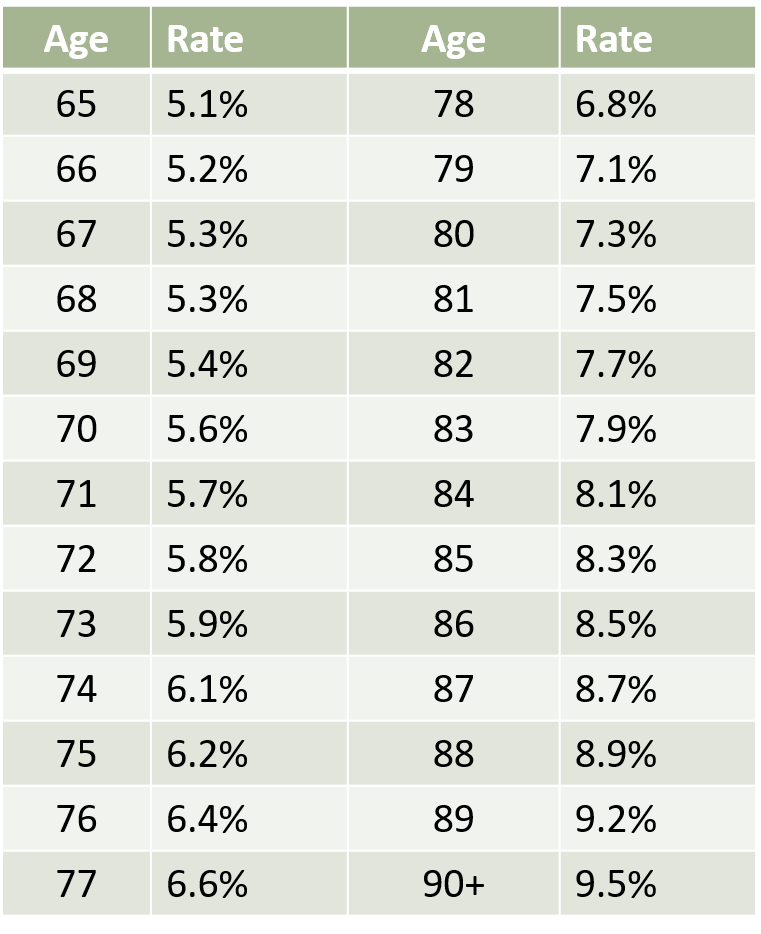

Rates for a Charitable Gift Annuity funded July 1 2018 or later.

. What is the minimum age and amount required to establish a Charitable Gift Annuity with ChildFund and begin receiving payments. Charitable Gift Annuities. Search For Charitable Gift Annuities at Bestdiscoveriesco.

Most charities require recipients to be at least 65 years old before. Basically a charitable gift annuity is a legal contract between you and Boys Girls Clubs that guarantees you a fixed income stream for life. Including your ages when you set up the charitable gift annuity.

You want the security of fixed dependable payments for life. When you establish a charitable gift annuity with the Oblate Annuity Trust minimum 5000 you will receive annual fixed payments for the rest of. What if I have not reached 60 years of age but have an interest in establishing a.

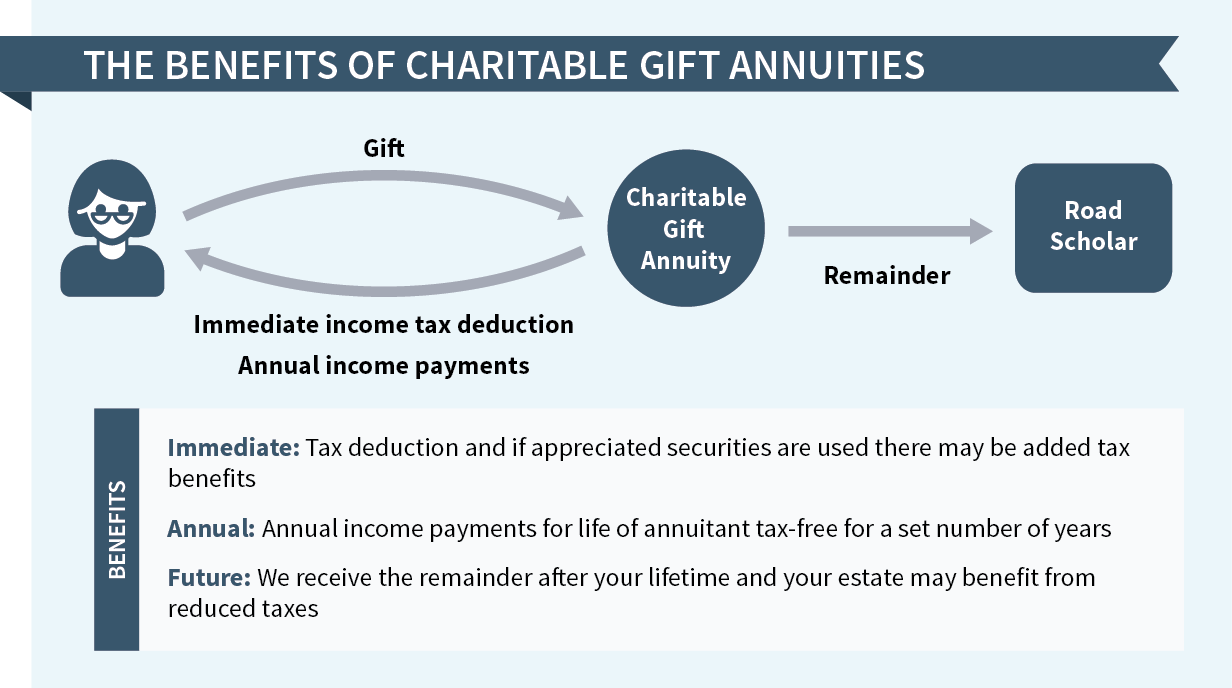

The minimum gift amount is 50000. A charitable gift annuity CGA is both a tax-deductible gift and an income-producing annuity. A charitable gift annuity provides fixed payments to you or others you name for life in exchange for your gift of cash or securities.

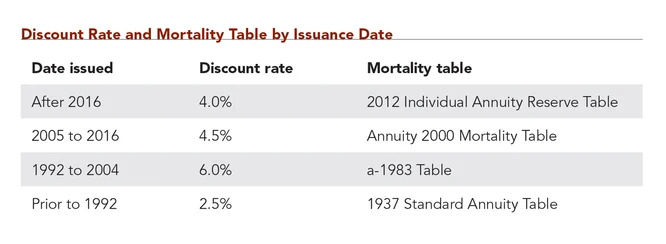

Charitable Gift Annuity. A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. 514 c5A using the 30 Charitable Federal Midterm.

The payment rate for joint gift annuities is lower than. You want to maintain or increase your cash flow. Most charities require an initial donation of at least 10000 to 25000 in order to fund these annuities.

A charitable gift annuity could be right for you if. If the annuity is deferred it is recommended that the minimum age of the annuitant at the time payments begin be the same as the minimum age of an annuitant of an. A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property.

Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans. Many states that regulate charitable gift annuities require the charity to supply. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals.

The University of Minnesota Foundation will offer these higher rates for new gift. Ad Annuities are often complex retirement investment products. 133 rows The suggested rates comply with the 10 minimum charitable deduction required under IRC Sec.

Learn why annuities may not be a prudent investment for 500000 retirement portfolios. A Charitable Gift Annuity provides a powerful tool by which donors can support a charitable organization while providing themselves a guaranteed income for lifeusually at above. Your calculation above is an estimate and is for illustrative purposes only.

Ad Find Charitable Gift Annuities. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year. The charitable gift annuity rates suggested by the American Council on Gift Annuities have increased.

Required form and instructions for non-profit educational religious charitable or scientific institutions seeking a certificate of exemption to issue charitable gift annuities. Bank of America Private Bank Is Here to Help with Your Philanthropic Goals. Learn some startling facts.

You must be 60-years-old to begin receiving. Our minimum age for a. A charitable gift annuity is a simple arrangement between you and Pomona College that requires a one or two page agreement.

Their ages at the time of your gift will determine their. Give Gain With CMC. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Minimum gifts for establishing a charitable gift annuity may be as low as 5000 but are often much larger. Establish minimum ages for immediate and deferred annuities. The minimum age for an AACR Foundation gift annuity is 60.

Typically the minimum contribution to start a. As with any other. You will incur no costs to establish the arrangement.

Ad Learn About Charitable Trends Behaviors and Priorities of High Net Worth Americans. Ad Earn Lifetime Income Tax Savings.

Ira Rollover Age 70 1 2 Or Older Women In Distress

Charitable Gift Annuities Giving To Stanford

Charitable Gift Annuity Rate Increases Texas A M Foundation

Charitable Gift Annuities Road Scholar

Ways To Give St Mary S Health System

At What Age Is Social Security No Longer Taxed In The Us As Usa

California Required Gift Annuity Reserves Change In Assumptions

Full Portrait Report Donors Of Color Network

6 Benefits Of A Charitable Gift Annuity Giving To Duke

Is A Roth Conversion Right For You Vanguard Roth Conversation Ira

Planned Gifts The Catholic Foundation

The Catholic Community Foundation Giving Tools Tempe Az